Private Equity Fund Structure Diagram

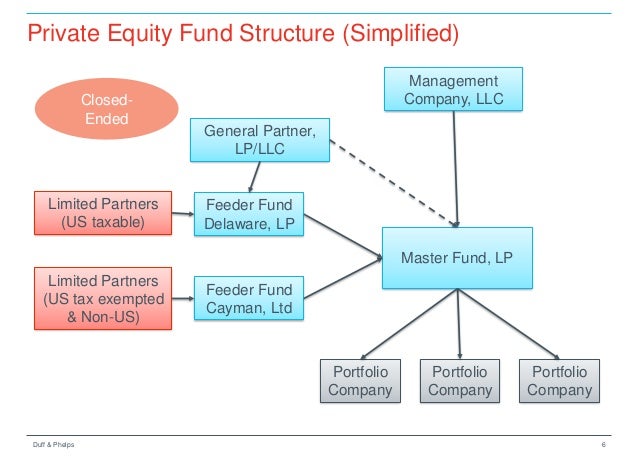

There has been little work addressing the specifics of private equity structures and their implications for the operating and capital partners that invest in them. Diagram of the structure of a generic private equity fund.

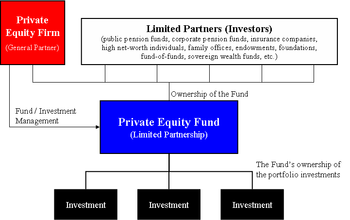

Investors acquire interests in the investment fund which makes the actual investments for their benefit see investment fund.

Private equity fund structure diagram. In private equity funds and joint ventures operating agreements between equity partners employ cash distribution rules that. Understanding private equity fund structure. All institutional partners of the fund will agree on set terms laid out in a limited partnership agreement lpa.

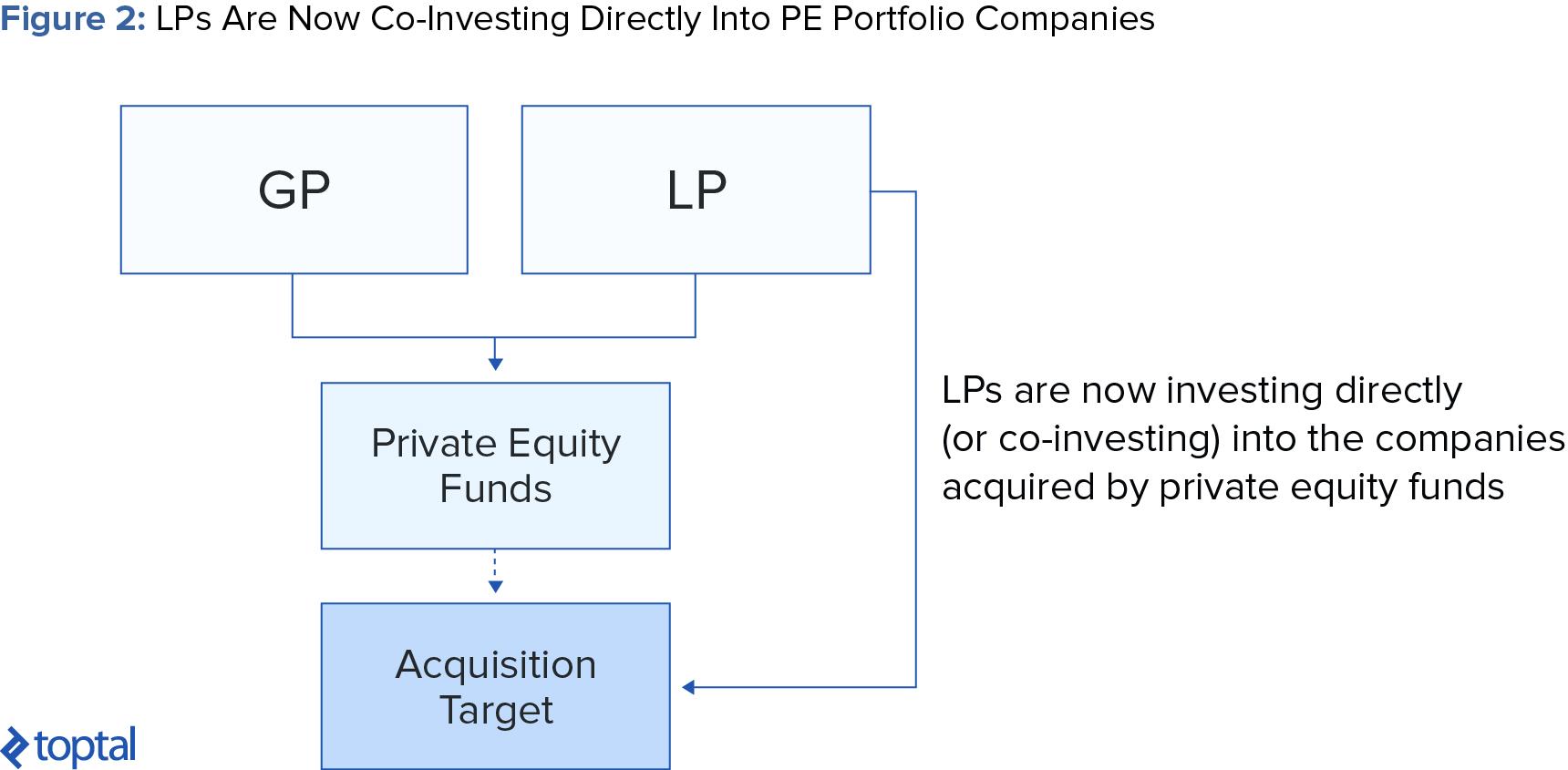

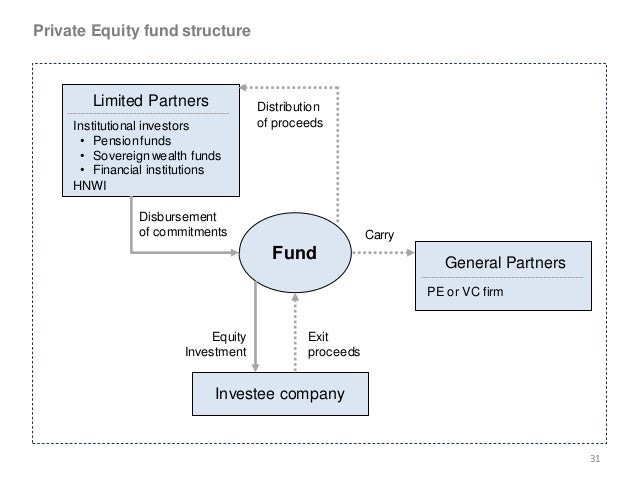

Private equity funds are closed end investment vehicles which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. The goal of the private equity firm is to turn a profit for their investors usually within five to seven years in exchange for management fees and a percentage. Pension funds to pe fund 2 annual management fees from fund to manager 3 investment made by fund into newco buying target company management also invests 4 may include direct company investment by limited partners.

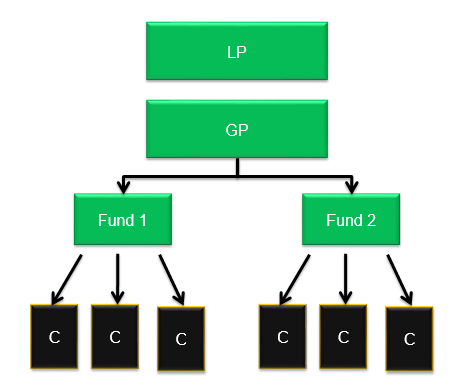

A feature of limited partnerships is that the general partner controls the fund and has no investor oversight. Private equity firms are structured as partnerships with one gp making the investments and several lps investing capital. 01162017 private equity fund structure.

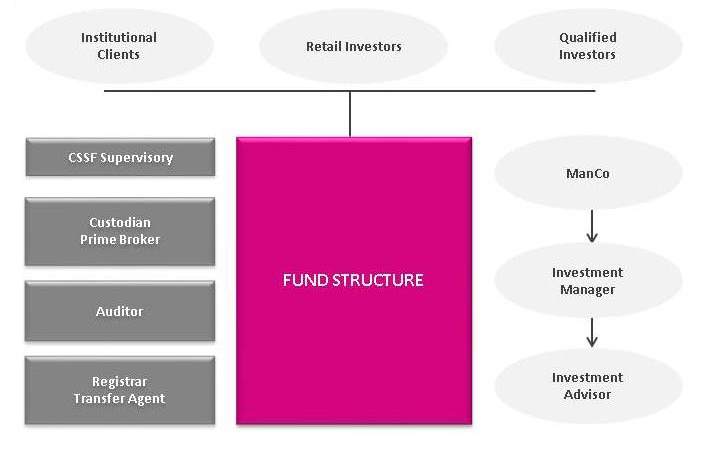

The structure of a private equity fund generally involves several key entities as follows. A private equity firm is a group that collects investment funds from wealthy individuals or institutions in order to purchase companies. Private equity fund performance.

Funds may consider purchasing stakes in private firms or public companies with the intention of de listing the latter from public stock exchanges and taking them private. These funds are generally formed as either a limited partnership lp or limited liability company llc. The investment fund which is a pure pool of capital with no direct operations.

Private equity manager sets up fund 1 commitment for funds from investors eg. This means that the most that a limited partner can lose is the total amount of its investment in the fund. Typically a private equity firm will raise pools of capital or private equity funds that supply the equity contributions for these transactions.

Us private equity fund structure the limited partnership. After a finite period the private equity fund will divest its holdings through a number of options. Some lps may also ask for special terms outlined in a side letter.

Private equity firms will receive a periodic management fee as well as a share in the profits earned carried interest from each private equity fund managed. The structure of private equity firms. Most private equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or lpa.

Expertise In Investment Funds Structures In Luxembourg Investment

Expertise In Investment Funds Structures In Luxembourg Investment

Fund Finance 2018 Credit Facilities Secured By Private Equity

Fund Finance 2018 Credit Facilities Secured By Private Equity

Tax Considerations In Structuring Us Based Private Equity Funds Pdf

Tax Considerations In Structuring Us Based Private Equity Funds Pdf

Extension Of Profits Tax Exemption To Private Equity Funds

Acquisition Finance Market Overview Structuring The Deal Joseph

How Kkr Structures Its Investment Vehicles

How Kkr Structures Its Investment Vehicles

Lp Corner Us Private Equity Fund Structure The Limited

Private Equity Fund Reviews Fund Reviews

Venture Capital 101 Structure Returns Exit And Beyond

Venture Capital 101 Structure Returns Exit And Beyond

Why Carried Interest Reform Should Be A No Brainer Roosevelt Institute

Private Equity Outlook 2017 Signs Of Fatigue Finance Banking

Private Equity Outlook 2017 Signs Of Fatigue Finance Banking

Lp Corner Private Equity Fund Cash Flows From The Lp Perspective

Private Equity And Venture Capital

Private Equity And Venture Capital

Hedge Fund And Private Equity Fund Structures Regulation And Crimi

Hedge Fund And Private Equity Fund Structures Regulation And Crimi

What Is Private Equity Overview Of Structure Deal Structuring Fees

What Is Private Equity Overview Of Structure Deal Structuring Fees

0 Response to "Private Equity Fund Structure Diagram"

Post a Comment